Irs Annual Gift Tax Exclusion 2025. For the year 2025, the irs sets specific limits on the amount that can be given to any number of individuals without incurring a gift tax or even needing to file a gift tax return. Estate & gift tax exemption:

The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2025). The basic exclusion amount for determining the amount of the unified credit against estate tax under irc section 2010 will be $13,610,000 for decedents who die in 2025, a $690,000 increase from 2025.

However, understanding how the annual gift tax exclusion works and its purpose is critical to avoid unwanted tax consequences and maximize your gifting potential.

This is up from $17,000 in 2025 and you never have to pay taxes on gifts that are equal to or less than the current annual exclusion limit.

Annual Gifting For 2025 Image to u, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Starting from calendar year 2025, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2025.

What Is Annual Gift Tax Exclusion For 2025 Glynda Juliann, The federal annual gift tax exclusion also increased to $18,000 per person as of january 1, 2025 (or $36,000 for married couples who elect to split gifts). The 2025 gift tax limit is $18,000, up from $17,000 in 2025.

Irs Gift Exclusion 2025 Carin Cosetta, The annual exclusion amount for 2025 is $17,000 and for 2025 is $18,000. In 2025, you can make annual gifts to any one person up to a maximum.

Gift Tax Rates 2025 Irs Edita Nickie, In 2025, the annual gift tax exclusion amount is $18,000 per recipient. Annual gift tax exclusion increase:

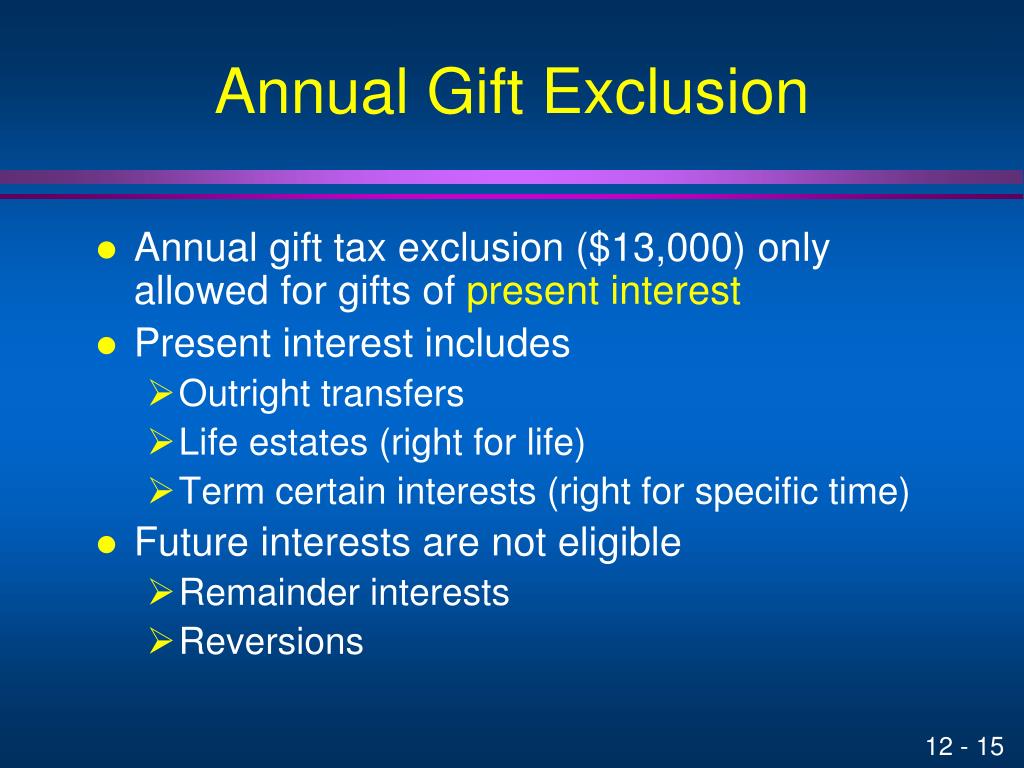

PPT Wealth Transfer Taxes PowerPoint Presentation, free download ID, Annual gift tax exclusion 2025 irs nike sabrina, in addition, the estate and gift tax exemption. The basic exclusion amount for determining the amount of the unified credit against estate tax under irc section 2010 will be $13,610,000 for decedents who die in 2025, a $690,000 increase from 2025.

Gift Tax, the Annual Exclusion and Estate Planning American College, Starting from calendar year 2025, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2025. Estate & gift tax exemption:

2025 IRS Annual Gift Exclusion, The annual exclusion amount for 2025 is $17,000 and for 2025 is $18,000. In 2025, individuals can gift up to $18,000 per year, up from the previous limit of $17,000.

2025 IRS Annual Gift Exclusion, For example, a taxpayer with three children can generally transfer up to $54,000 to them. Annual gift tax exclusion 2025 irs nike sabrina, new delhi [india], july 3:

What Is the Annual Gift Tax Exclusion YouTube, The irs typically adjusts this gift tax exclusion each year based on inflation. However, understanding how the annual gift tax exclusion works and its purpose is critical to avoid unwanted tax consequences and maximize your gifting potential.

annual gift tax exclusion 2025 irs Trina Stack, The annual gift tax exclusion increases to $18,000 for 2025, up $1,000 from 2025. The annual exclusion for gifts is $18,000 for calendar year 2025, an increase from $17,000 for 2025.