2025 Roth Ira Max. This figure is up from the 2025 limit of $6,500. Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. 2025 roth and traditional ira max contribution limits.

Roth Limits 2025 Theo Ursala, 2025 roth and traditional ira max contribution limits. If you are 50 or.

Roth IRA Limits And Maximum Contribution For 2025, In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above. $8,000 if you're age 50 or older.

What is a Roth IRA? The Fancy Accountant, Roth ira contribution limits (tax year 2025) Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

IRA Contribution Limits 2025 Finance Strategists, 12 rows the maximum total annual contribution for all your iras combined is: The roth ira contribution limits increased in 2025 and are moving up again in 2025.

Roth IRA contribution limits aving to Invest, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. If you are 50 or.

Roth IRA Limits 2025 Debt Free To Early Retirement, For 2025, this limitation is increased to $53,000, up from $50,000. To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

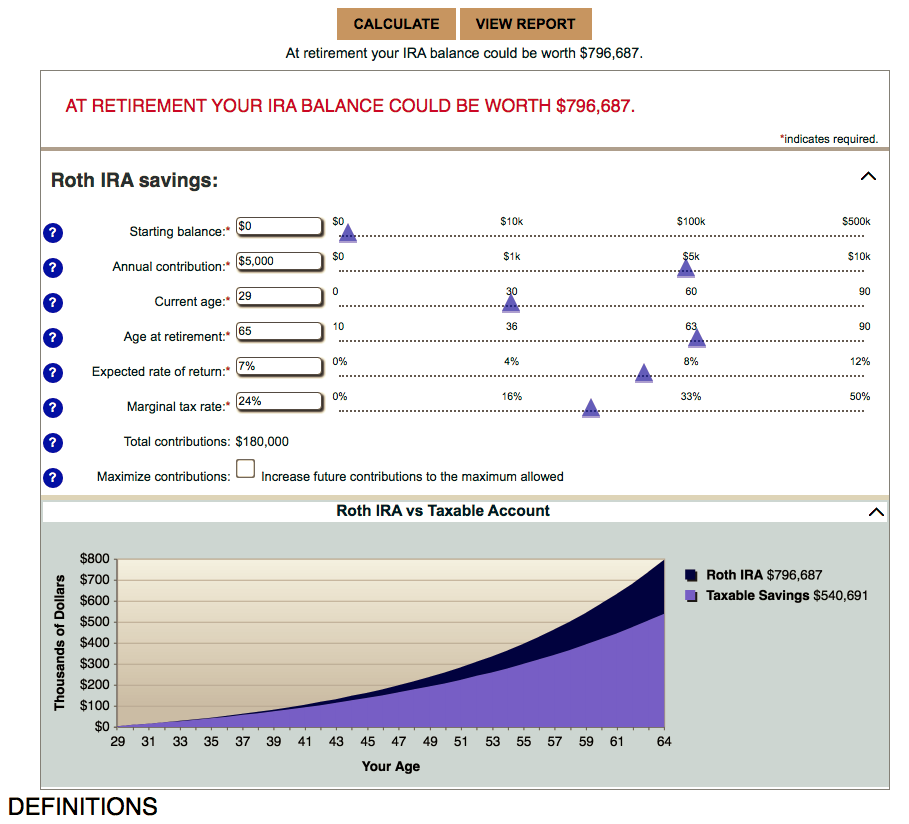

How to Use a Roth IRA Calculator Ready to Roth, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. The roth ira contribution limits increased in 2025 and are moving up again in 2025.

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth. If you're 49 and under, you can contribute up to $7,000 to a roth ira in 2025.

401k 2025 Contribution Limit Chart, Traditional ira 2025 contribution limit. If you qualify to tuck away money in a roth ira in 2025, you'll be able to tap into the biggest contribution limits we've ever seen.

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, Traditional ira 2025 contribution limit. For 2025, the maximum contribution rises to.

The maximum annual contribution for 2025 is $6,500, or $7,500 if you're age 50 or older, and you can make those contributions through april of 2025.